The most basic definition of economics is the study of how people, businesses, societies, or nations make decisions in the face of scarcity. Are you curious about the influences and processes involved in the United States economy? Would you like the tools to assess the current state of the economy? You may be considering a career in economics, or in need of taking a course on economics for further insight into your business endeavors. Introduction to Economics will give you the big picture in just 10 minutes. Using the additional resources, you can spend 2 hours studying the economic concepts even further.

Table of Contents

Foundations of Economics

What do Economists do?

Economists study how and why people, businesses, societies, or nations distribute resources and the associated implications for human wellbeing. This is done in many different settings and jobs such as professors, consultants, government advisors, or private-sector employees.

But How?

Economics relies on math, statistics, data, and reasoning. Economists use mathematics-based theory and reasoning to depict different economic relationships. They also collect data on various economic indicators and analyze this data.

Then What?

Economists try to provide useful information to decision-makers. Economists study key issues related to the scarcity of resources and look at the impacts different decisions may yield. For example, what is the nature and magnitude of cause-and-effect? How did we get here? What would happen if…? What are the costs and benefits of an action (or inaction)? What is the best way to accomplish a goal? Economists use different theories, data, math, and statistics to help solve real-world problems. They study human behavior. They evaluate different programs. They explain social phenomena. The contributions from economists inform everything from the large public policy decision to basic household decisions.

What do you think?

How does economics help us understand current social issues?

Additional Resources for Foundations of Economics

Microeconomics and Macroeconomics

Economics is an expansive field that covers a lot of different topics. These topics can be divided into two fields: microeconomics and macroeconomics. Microeconomics is concerned with the actions of individuals in the economy such as workers, businesses, or households. Macroeconomics is concerned with the economy as a whole and focused on issues such as employment, inflation, government spending, exports and imports, and unemployment.

Microeconomics

Consumer and firm behavior are at the heart of microeconomics. This field seeks to understand how individuals make decisions; the factors that influence their decisions; and how their decisions affect others. Key concepts involved in the study of microeconomics include incentives and behaviors, price theory, utility theory, and production theory.

Macroeconomics

The behavior of the overall economy is at the center of macroeconomics. Macroeconomists attempt to answer key questions such as: What stimulates economic growth? What causes unemployment to rise or fall? How do we measure the success of an economy? What causes inflation to rise or fall? These questions can be answered in many ways depending on the viewpoint of the economists. Macroeconomics is organized into many schools of thought, but the two most well-known are classical and Keynesian.

Classical vs. Keynesian Economic Theory

Classical economics builds off theories from Adam Smith and asserts that prices and wages are flexible and the economy is at full employment at all times. Keynesian economics relies on ideas from the works of John Keynes and asserts that wages and prices can get stuck and the economy can go above or below the full employment level.

What do you think?

Which field of economics are you most interested in learning more about?

Additional Resources for Microeconomics and Macroeconomics Economics

- Microeconomics Models and Theories – Economics Help

- The Keynesian Model and the Classical Model of the Economy – Study.com

Supply and Demand

The concept of supply and demand is one of the most fundamental concepts of economics and free markets. The concept states that the price of goods and services is determined by the supply and demand in the market. Let’s take a closer look, starting with demand.

Demand – How much of something consumers want to buy.

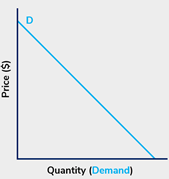

The primary driver of demand for a good or service is the price of the good or service. Think of going to the grocery store. You want to purchase paper towels. The lower the price of paper towels, the more you are inclined to buy (maybe two rolls instead of one). This is the law of demand in the simplest sense: the lower the price, the higher the demand. The levels of price and demand can be quantified to form a demand curve (see below)

Supply – How much of something suppliers have to sell.

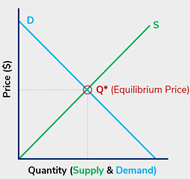

To understand supply, we must now look at the opposite side of the market. If you are a manufacturer or seller of paper towels, it is the opposite: the higher the price, the more paper towels you want to supply or sell. This is the simple definition of the law of supply: the higher the price, the higher the supply. Just like with demand, the levels of price and supply can be quantified to form a supply curve (see below)

Finding Equilibrium

To determine the market price of a good or service we must combine the law of supply and law of demand. Where the supply and demand curves meet is known as equilibrium. This equilibrium represents the optimal price for a good or service given the levels of supply and demand in the market.

What do you think?

How does supply and demand affect the economy?

Additional Resources for Corporate Finance

- What is Supply and Demand? Back to Basics – IMF.org

- Supply and Demand, Markets and Prices – Econlib.org

- Example of Supply and Demand (YouTube)

International Economics

International economics is a specialized field in economics that evaluates economic interactions between countries. This field addresses many topical issues such as: why do countries trade, free trade and protectionism, exchange rates, how countries manage their finances, and economic integration. Broadly, international economics is concerned with two areas: international trade and international finance.

International Trade

International trade is the exchange of goods and services between countries. A grocery store in the US may be stocked with Brazilian coffee, Mexican avocados, and French wine. This is the result of international trade.

Why do countries trade? Consumers can access different goods or services not available in their home countries because of international trade. Prices of already available goods or services can be reduced because of international trade. International trade enables countries to use their resources (i.e. labor, technology, and capital) more efficiently.

International Finance

International finance is a branch of economics concerned with the financial interactions between countries, such as foreign direct investments (FDI) and currency exchange rates. Institutions such as the International Finance Corporation (IFC) and the National Bureau of Economic Research (NBER) are key players in this field.

Why does international finance exist? Today’s economy is globalized. Countries trade between and borrow money from each other, businesses buy and sell goods abroad, and other organizations are operating on an international scale. International finance exists to help keep the peace between nations in this interconnected and globalized economic environment.

What do you think?

What are the affects of international finance on the American economy?

Additional Resources for International Economics

- Free Trade Vs. Protectionism – Chron.com

- SearA History of International Finance – VOX, CEPR Policy Portal

- How to Rebuild the Global Economy (virtual conference)- TED Talk

Game Theory

Game theory is a branch of applied mathematics that is used by economists for studying rational decision making between parties. It is widely used in many professional fields outside of economics; political science, computer science, even politics rely on game theory models to inform decision making.

A “game” refers to a situation involving at least two “players” (players can be consumers, businesses, countries, etc.). The players have a set of possible decisions to make and the outcomes of their decisions depend partially on those made by other players in the game.

Simultaneous and Sequential Games

Simultaneous games are those in which the players make their decisions at the same time. Players have no knowledge about the choices made by other players. Sequential games are the opposite. Players are aware of the moves made by the other players before they make their own decision.

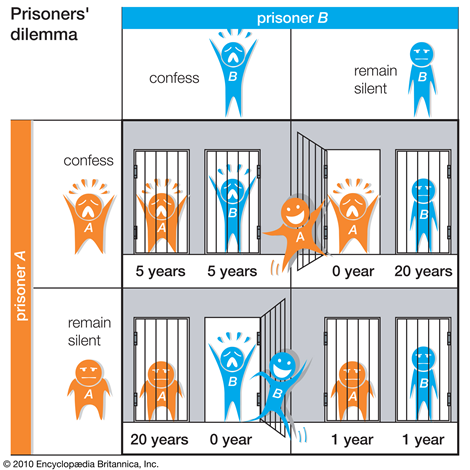

The most well-known type of problem in game theory is called the Prisoner’s Dilemma. In this game, we assume there are two prisoners suspected of committing a crime. Each prisoner is isolated (no knowledge of the other player’s move) and both are being urged to confess. The players in this game have two choices, either confess or remain silent. We can model the decisions and outcomes (or “payoffs”) in the following model:

What decision would you make in this situation? Using game theory, we can solve this puzzle. To see a detailed analysis of how this game is solved, visit this great article on Britannica.com.

The solution to this game is that both prisoners will choose to confess. Why is this the case? Had each prisoner remained silent they would both be facing a lesser sentence. Game theory provides us a formalized framework to study conflict and cooperation situations similar to this.

Applied to economics, game theory is used most commonly to predict and rationalize people’s behavior. This can be used to study auctions, merger pricing, oligopolies, bargaining, and much more.

What do you think?

How is game theory useful in real life?

Additional Resources for Game Theory

Economics Systems

An economic system is a way in which a society chooses to distribute resources (i.e. goods and services) in an economy. The type of economic system chosen by society will influence its regulation of production, labor, resources, and entrepreneurs There is not a one-size-fits-all approach to economic systems – the structure and organization of systems vary throughout time and across geographies. However, all economic systems do share some basic features and can be organized into four main types: traditional, command, market, and mixed.

Traditional Economies

A traditional economic system is based on goods, services, and labor. This system relies heavily on people and there is very little labor specialization or division. A traditional economy is the most basic system of the four types and still prevalent in underdeveloped and third-world areas of the world. Think about areas that depend heavily on farming. This would be an example of a traditional economy. Each member of the economy has a specific role and the societies tend to be very close-knit. Traditional economies tend to lack access to technology, advanced medicine, and a surplus of resources is rare.

Command Economies

A command economic system is based on large control by a centralized power like the government. Think of an economy like the USSR. Most decisions were made by the central government. The government in a command economy tends to be heavily involved in the production and distribution of resources. A surplus of resources is possible in a command economy and governments can theoretically create jobs for most of the population. Command economies can face difficulties planning for everyone’s needs and industries tend to suffer from a lack of innovation. The government will typically own all of the key industries such as utilities and infrastructure, and most will focus on the most valuable economic resources such as oil.

Market Economies

A market economic system is synonymous with a free market system. In a free market system, there is a clear separation between the government and markets. This is in stark contrast with command economies. Market economies are driven by the actions of individuals and firms and the forces of supply and demand. More detailed information about free-market systems was presented earlier in this article.

Mixed Economies

A mixed economic system combines different elements of the three systems above. It is most commonly a cross between a command economy and a market economy. There is typically limited government ownership of industry save for areas related to national defense and security. Governments are involved with regulating industry and private businesses. Most developed economies today are actually mixed economies, mixing aspects of the free market and command systems.

What do you think?

What do you think are the advantages and disadvantages of traditional, market, command and free economy?

Additional Resources for Economic Systems

- Is the United States a Market Economy or a Mixed Economy? – Investopedia

- What is a Command Economy and What are Some Examples? – TheStreet

- Command and Market Economy- Khan Economy

The Free Market

What is the Free Market System?

A free-market system is an economic system controlled by market forces as opposed to government regulation. In a free market system, the laws of supply and demand rule and government controls (think price-cutting, production requirements) do not exist. Here are the top three characteristics of a free market system:

- Private ownership – In a free market, companies, and resources are owned by private individuals. State-owned enterprises or nationalization of key resources do not exist. Private parties control the means of production. Private parties also control the allocation of resources, exchange of products, and labor supply.

- Prosperous financial markets – A free market system requires functioning financial institutions like banks and brokerages. These institutions facilitate the exchange of goods and services and capital funding.

- No government control – Any individual can participate in a free market system. There are limited to no barriers to entry. Companies and individuals can choose to produce or consume goods at their discretion.

Pros and Cons of a Free Market

+ Innovation: Business owners are free to develop new products, ideas, and services based on customer demands. Freedom to innovate fuels competition and the development of new technologies.

+ Consumer-centric: Consumers make the final decision on which products succeed or fail in a free market. Consumers also determine the price of the products through their choice to purchase or not. This creates a market environment where the best products are likely to succeed at a price considered fair by both consumers and producers.

– Profit motive risks: The objective of businesses in a free market economy is to maximize profit. In some cases, this profit motive can result in businesses cutting corners and increasing risk. Businesses may sacrifice worker safety, environmental standards, or ethics in pursuit of increased profits.

– Market failures: Free markets are susceptible to market failures with significant consequences. Think of the Great Depression of the 1930s or the real estate market crash in 2008. These are both examples of market failures in a free market system. These failures can have lasting negative outcomes on wages, employment, and even homeownership.

What do you think?

How do you see a free market in the United States? In what ways is the USA not a free market economy?

Additional Resources for the Free Market

- What Are Some Examples Of Free Market Economies? – Investopedia

- How a Free Market Really Works (YouTube)

Economic Indicators

Economic indicators are economic data used to interpret the current macroeconomic environment. Government agencies, nonprofits, and select private organizations release this data on a daily, weekly, monthly, and/or quarterly basis. Analysts rely on economic indicators to inform investment and policy decisions. Economic indicators are a key tool for understanding the overall health of an economy.

Economic indicators are generally grouped into three high-level categories: leading, coincident, and lagging.

1. Leading economic indicators: Leading indicators predict future movements in the economy. Examples of leading indicators include the yield curve, consumer durables, share prices, or new business formations. Typically, these data points will make movements before the economy.

2. Coincident economic indicators: Coincident indicators show the current state of economic activity. Gross domestic product (GDP) is the most well-known coincident indicator. These indicators are vital as they provide economists and policymakers with a gauge of the current state of the economy. Other examples of coincident indicators include employment levels and retail sales.

3. Lagging economic indicators: Lagging indicators are data sets that show information after the fact. Examples include the gross national product (GNP), consumer price index (CPI), and unemployment rates. Lagging indicators are useful for understanding general trends in the economy or tools for business strategy and operations.

What do you think?

What is the leading economic indicator?

Additional Resources for Economic Indicators

- Economic Indicators – U.S. Department of Commerce

- The Top 10 Economic Indicators to Watch and Why – AAII

Typical Economics Courses

Principles of Economics – In this course students are introduced to the basic tools of microeconomic and macroeconomic analysts. The focus on microeconomics introduces concepts surrounding the consumer, firms, income distribution, and markets. The focus on macroeconomics introduces national income, inflation, money supply, and employment.

Financial Accounting – In a financial accounting course students learn the language of business: accounting. Students pursuing a career in economics must be comfortable with accounting and this course exposes them to financial statements of private companies and nonprofits. Other topics covered may include international accounting, investment decisions, and accounting ethics.

International Economics – In this course students explore foundations of international trade, commerce policies (i.e. tariffs and quotas), and international finance. Other topics covered may include the foreign exchange market, open economy macroeconomics, and balance of payment analysis.

Microeconomics – Consumer behavior theory, firm theory, market structure, and price determination, income distribution, equilibrium analysis, and market failure are all topics explored in microeconomics courses.

Macroeconomics – In a macroeconomics course, students will take a deep dive into the theories of determining national income, employment, and price levels. Economic models will be introduced and debated, and significant attention will be paid to the behavior of the national economy.

Comparative Economic Systems – Students examine the mechanics of different economic systems in this course from the perspective of incentives facing the consumer and firm.

Additional Resources for Typical Economics Courses

- What an Economics Major Should Take – EconLib.org

- What You Need to Know About Becoming an Economics Major – U.S. News

- Best Online Courses in Economics

Types of Economics Degrees

There are four main types of degree programs available for those interested in pursuing economics: associate’s, bachelor’s, master’s, and doctorate.

Associate Degree in Economics

An associate degree in economics is a two-year program that provides a foundation of knowledge in areas of economics such as financial planning, budget development, and basic economic analysis. This degree is a sensible option for students if they have plans to eventually transfer into a bachelor’s degree program. This degree will qualify graduates for entry-level positions that require a high-level understanding of economics and finance fundamentals.

Bachelor’s Degree in Economics

A bachelor’s degree in economics is a longer program, typically four years, that can be earned live or online. This degree dives deeper into areas of economics and provides students the opportunity to focus on different concentrations (microeconomics, macroeconomics, etc.). This degree will qualify recipients for mid-level positions such as market research analyst, economic consultant, actuary, credit analyst, or financial analyst.

Master’s Degree in Economics

There are multiple types of economics master’s degree programs. Some students choose to pursue a master’s in general economics while others focus on a more specific area of economics. A Masters of Business Administration (MBA) is also a common choice for students who are interested in the field of economics. Any of these master’s programs will provide students with a high level of understanding of economic theories and are likely to increase earning power and job prospects.

Ph.D. in Economics

A Ph.D. in economics prepares candidates for careers as researchers and professors in highly specialized areas of economics. Achieving a Ph.D. in economics can take between five and six years for many candidates. Being awarded this degree is a recognition of one’s accomplishment as an economist and ability to make significant contributions to their chosen field of specialization.

Additional Resources for Types of Economics Degrees

More Courses:

- Introduction to Finance

- Introduction to Accounting

- Introduction to Entrepreneurship

- Introduction to Business Administration

- Introduction to Philosophy

- Introduction to Nutrition

- Introduction to Investing

- Introduction to Interior Design

- Introduction to Digital Marketing

- Introduction to Real Estate

- Introduction to Hospitality Management

Andrew Ziebarth

Master of Business Administration (M.B.A.), Finance | University of Pennsylvania – The Wharton School

United States Military Academy at West Point

May 2020